WHY RELATIVITY MATTERS IN AGRO-BUSINESS INVESTMENTS?

BY DR. NIMROD

There are many reasons why investments do not “run” to invest in the African agricultural sector.

One reason is a misconception of the high risk-aversion attitude when investing in an unprofessional farmer.

This article presents an unconventional opinion on why it is wiser, provided it is done within a suitable business model and with proper professional support to invest in a non-professional farmer.

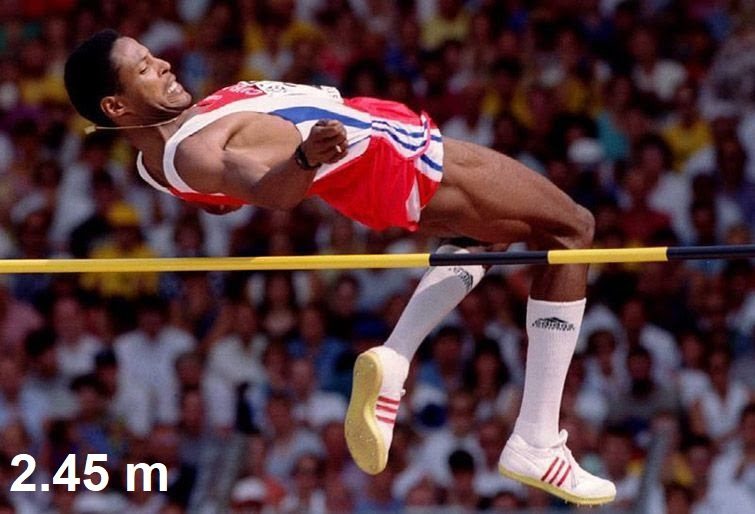

WHO WILL YOU CHOOSE, WORLD CHAMPION OR AMATEUR?

The current world record in the high jump for men was set in 1993 by Javier Sotomayor at 2.45 meters.

If you compare, in the high jump, my performance to Javier’s jump, you will see that I do not excel in the high jump. For me, even a hurdle of one meter may be a challenge.

Suppose you are an investor who wants to invest 10$ on a high jumper, hoping to win 100$ if your jumper wins. You would probably put your money on the world champion, Javier. Right!?

Now we set a contest with slightly different rules. You still have 10$ to invest, but you win 100$ whenever the high jumper you chose added 1 cm to his record.

Under these rules, it makes sense from your side to choose and invest in me precisely because of my low starting point.

Why choose the amateur? Because you understand that with only a little support and training, the amateur can add one cm, and probably many more after that, while Javier has already reached his and the human limits.

GROWTH RATE

Often investors work in a way I presented in the second scenario above. Meaning, investors invest in companies/entrepreneurs having the most significant and fastest potential for rapid high Growth Rate (GR).

A company’s value is set according to its Potential for high GR; low GR decreases the value, while high GR increases it.

Yes, investors are looking for a rapid Growth Rate potential, which is why so much money is invested in start-ups.

In addition, and as it is with every investment, the investor would study the market, team, technology, field results, etc.

The above is very important in agro-business, which requires a strategic view and long-term commitment.

THE CHINA OF AGRO-PRODUCTION

China has become the global factory for industrial products thanks to realizing its potential for “quality improvement” and a high “quantity increase”.

However, forty years ago, many experts didn’t see or even consider that China would become the superpower of industrial production, which it is today. No one accurately described the opportunity of the near future (>20 years).

For similar reasons, I declare that “Africa will be the China of agriculture production.”

This is true even if today you find it hard to see or believe.

The role of agriculture is to provide high-quality and plentiful food to the (growing) general public.

Africa’s agro-industry can do so and, with some help, can realize it in the coming years.

The vast money spending (expenses) and the potential of the enormous number of African farmers ensure the scalability of agricultural production almost at any required extent and level.

THE MISSING COMPONENT

Africa has vast productive lands, a diverse climate suitable for abundant crops, a large workforce, a substantial local market, and (essential for supply) proximity to the major markets in Europe and Asia.

But to fulfill this potential and bring it to fruition, we need “activation energy.”

What is this “activation energy?”

In the case of China, the “activation energy” was investments in production facilities by non-Chinese companies, assured access to export markets, plus the ability to export to premium markets at a premium price.

For Africa to escape poverty, it must increase the export of high-value products to premium markets at a premium price and assure the flow of currency from abroad.

Biofeed understood this and, therefore, designed, developed, and implemented the Green Valley program specially tuned for farmers, particularly smallholders in Africa and emerging economies.

What precisely is Green Valley, and what it does?

Green Valley considers every hectare and orchard as the equivalent to a Chinese industrial plant.

Accordingly, Green Valley’s role is to help farmers improve the quality of their produce to the Export Quality level and then allow them to export it at a premium price to premium markets.

Green Valley is taking the place of the trainer who helps the amateur jumper to improve his high jumps, one cm at a time.

Of course, there are significant differences between traditional industry and agriculture.

For example, a plant can be built within a few months, while it takes years for an orchard to reach its full annual yield potential.

As you will see, this was taken into account when we considered the right crop for investment in the frame of the Green Valley program.

CRITERIA FOR CHOOSING A CROP FOR INVESTMENT

When it comes to investing in the agro-industry, we will do well if we invest in crops that meet the following requirements –

Loved and desired by many.

Loved and desired by many.

Has great demand.

Has great demand.

Continuous growing demand.

Continuous growing demand.

The market for such a crop is accessible.

The market for such a crop is accessible.

Ability to market year-round.

Ability to market year-round.

High value-added.

High value-added.

The crop already exists and is planted in a significant size area.

The crop already exists and is planted in a significant size area.

High ability to swiftly improve its quality to “export quality.”

High ability to swiftly improve its quality to “export quality.”

Potential for scalability.

Potential for scalability.

After analyzing the possibilities, we concluded that Mango is the African crop that best meets the above requirements.

Green Valley, with its novel technology, including unique protocols, and breaking through business-model, enables smallholders and professional mango growers to increase almost instantly (less than a year!) their “export quality” production by 50% to 500%! Read the grower income and investor profit are both “sky high.”

To provide a complete service, as required and needed by farmers, Green Valley also helps farmers to market and export their produce to the best premium markets at a premium price.

| SUMMARYAs in the case of start-ups, early-stage investments are worth more versus those coming later when the “professional gap” is closing between farmers in emerging and developed economies.Green Valley‘s holistic approach business model is tailor-made for farmers in emerging economies. Hence, it encapsulates the entire value chain.Furthermore, Green Valley brings complementary novel technologies and protocols, such as the Freedome (fruit fly non-spray solution) and the Fruit Fly Certified Trade Zone protocol (FFCTZ).Finally, investing in Africa / emerging economies is easy, profitable, and designed for long-term risk-avert investors.This became possible only now, after and thanks to a series of breaking through developments of technologies, and protocols, wrapped up in tailor-made agro-professional business models and led by a team of dedicated experts.It is now the perfect time for investors to step in and do the right thing for farmers in poverty, consumers who wish to have healthier produce, the environment, and even for their business and the legacy they would leave to their children.Early investors in China’s industry profited more than those investing today. The same is valid with Africa’s agro-industry, which now holds the best opportunities. |

| I would love to see you stepping up, joining my efforts, and becoming an active business partner/investor in Green Valley’s projects and global vision. |

| TAKEAWAYS» INVESTING IN unprofessional farmers can be very profitable.» CHOOSING THE RIGHT CROP is imperative to maximize investments potential.» A WISE AGRO-INVESTMENT is a Package of technologies and protocols wrapped in a proper business model.» THERE IS NO replacement to professional support and “feet on the ground” to ensure successful implementation of the technologies and protocols. Please press on the picture to follow me on LinkedIn. |

| If you enjoyed the article please share it with friends and colleagues. |