FARMERS AND INVESTORS’ MODEL FOR MUTUAL BENEFIT AND PROFIT

by Dr. Nimrod

in my articles, I address general phenomena. Mention of a country/continent is for illustration purposes only.

THE OPPORTUNITY LAY WHERE THERE IS A PROBLEM

It is clear that to improve and accelerate the agriculture of emerging economies and convert them into a successful agri-business, there is a need for significant investments.

Based on economic analysis and my personal experience, it is visible that Africa and Asia’s agro-business potential is inexhaustible.

So why are only a few investors ready to invest in those continents, harboring most of the world’s farmers?

CURRENT INVESTMENT MODEL

It is quite apparent why farmers need investments; they need to bridge an extended period (from one harvest to the next) before seeing the results of their investment, their effort, and labor, which is when the produce is ready to sell.

Farmers growing fruits need to wait a whole year before selling their fruits and getting money (ROI). Until that takes place, they desperately need financial support.

It is less understood why investors would like to do business with farmers. The current reality is that in most cases, investors do not interact or invest in farmers.

Maybe because it is not aligned with their business model, the field of expertise, or fear of investing in something located far away, exposed to the elements, offering high risk and low ROI potential.

Is this the fate of farmers in the emerging economies, to continue in the current path without developing and without economic well-being?

Is it possible to change that situation and attitude by bringing confidence to investors to invest in the agro-sector of Africa, Asia, etc.?

To answer that question, we need to study and learn the reasons and motivations of investors that already invest in farming in those markets.

When I say “investors,” I relate to – parties or agents like importers, distributors, produce traders, exporters, and even financial services (like short term bank loans).

Why are those investors ready to invest in some farmers?

Their strategy is simple and based on minimizing risks and increasing confidence in the positive result. They invest small amounts, for short terms, in farmers which they know.

Then they are passively waiting until harvest, hoping the produce is of the required quality and quantity so it can be sold with a profit. Then they get their investment, plus a certain upside, back.

Such investors often protect themselves by having some collateral, e.g., the farm or the future produce, or some other guarantee.

However, due to tiny margins, sometimes even negative, most farmers will find it hard to get any investment. This is because their business is too risky for any investor to deal with.

Below is an example presenting the high risk for African farmers when marketing their MANGOES in the local market.

Try to view that example through the eyes of an investor and think, “would I be ready to invest under such conditions?”

EXAMPLE

The economics of African mango growers selling in LOCAL markets. In parentheses is the typical range.

Current fruit loss due to fruit fly infestation – 50% (30% to 80%).

Cost of fruit fly control – 700 €/hectare (500 to 1000 €/Ha.). May rise up to 2,000 €/hectare if bags or SIT are used.

Yield: 10 tons/Ha. (5 to 15 T/Ha.).

Price for farmer: 0.30 €/kg (0.1 to 0.5 €/kg).

Potential income in the LOCAL market is, therefore – 3,000 €/Ha. But due to 50% fruit fly fruit loss, costly control, and low yield, the actual income is ONLY – 800 €/Ha.

In reality, the situation among mango growers is so bad that most growers abandoned their plantations in Togo, and in neighboring Ghana, about 40% abandoned their farms. Unfortunately, this reflects the situation across Africa.

Therefore, the existing investment model is intended to enable the continuation of the current (unfortunate) reality of the farmers’ status, based on the same produce quality, quantity, and income results.

To convince investors to put their money into agriculture, we need to create a new model, which offers a business environment with lower risk and higher confidence.

The way to do so is by improving the agricultural and business results!

Improved results are tightly coupled with farmers’ needs for more significant investments and sometimes also for more extended periods, not just for a single season?

For such tasks, the current investment model is unsuitable. To jump-start Africa’s agriculture, we need a different kind of business and investment model.

It has to be pure Africa agri-business-oriented, strategic, and competitive with investment options other than agriculture.

PARTIES OF THE AGRI-BUSINESS DEVELOPMENT MODEL

A successful model to enhance the agro-industry is one where all involved parties benefit more by applying it.

Let us take a moment to define the parties, understand their position (point of view) and motivations. When needed, I will use examples from the mango agro-industry.

FARMER – Need to finance his expenses throughout the year. His business relies on income from the harvest. Currently, he is limited on the capitalization of his property (i.e., farm) and produces. He has a limited field size, and therefore he must increase his income per hectare.

INVESTOR/ INVESTMENT– In the context of the required model, an entity that allows a farmer access to financial resources or resources with monetary value (like services or products) without requiring immediate payment will be considered an investor is doing an agro-investment. Such entities include; distributors, baking loan providers, pre-payments by traders or exporters before harvest, service providers (e.g., packing house), products supply (e.g., crop protection), etc.

We are all aware that any investor compares investment options and is interested in a higher and faster, free of risks, return on investment (ROI).

An investor will give up a potential investment if the risks seem too great.

Therefore, investors are looking for trusted partners and increasing chances of seeing their investment back by making sure (when possible, actively) that the suggested investment plan is realistic and adequately and professionally executed. Investors will look for collateral to ensure their investment.

EXPORTER/TRADER – Looking to get from the farmer the produce at the required quantity at the right quality and at the right time.

Those to maximize the deal’s potential by selling the produce at the highest market price. Export markets are often the best option.

Under some circumstances, they may serve as investors through pre-harvest payments.

TRUSTED PARTNER (TP) – TP is the financial arm of Green Valley. TP is trusted by everybody involved in the agri-business process. TP is responsible for enabling the mutual business or goods (and money) exchanges between parties.

TP is THE one responsible for ensuring that the professional plan is appropriately executed.

TP is eligible to fill up additional rolls, such as investor or exporter or others to be defined among the business partners if needed.

Main tasks within the TP responsibility include:

* TP is the party which in practice obtaining the investment and managing the finance to maximize the usage of invested funds, including purchasing goods and services.

* TP is managing the ‘flow’ of the produce within the value chain, from field to the shelf.

* TP is responsible for Post Sale Profit distribution among the partners, as pre-agreed.

GREEN VALLEY AGRI-DEVELOPMENT INVESTMENT (ADI) MODEL

There is little chance of attracting business-oriented investors based on the current marginal profit in the agro-industry, local market-oriented.

We can significantly increase the income per kg., when we sell our produce to premium export markets, often offering higher prices by tens of percent.

If we use the mango industry example, as we did above, we can see that an average income is about 800 €/Ha.

Due to the devastating impact of the fruit fly infestation, in practice, the income varies from rarely 2,500 €/Ha., to practically nothing!

However, when the same mango is intended for high-value export markets, we need to have zero fruit fly infestation, meaning there is no more fruit fly damage, although there are still expenses for its management.

When exporting, farmers can expect a higher price per kg., say 0.75 €/kg (ranging from 0.4 to 1.0 €/kg), which translate to a potential income of 7,500 €/Ha., which is about 300% more than the rare income when currently selling to the local market.

That difference is the potential gap of value and profit for any involved party.

That is the GAP for the value chain partners to be closed and profit from.

Even if we deduct 30% from the 7,500 €/Ha. income, we remain over 5,000 €/Ha., which is well above the current African or Asian situation. Clearly, leading farmers will do much, much better.

But more importantly, business-oriented investors can finally see the prospect of sizable profit margins, which at last make investing in agro-industry an attractive long term profitable and attractive investment option.

Based on information from countries already exporting mangoes, we see that exports and sales to premium markets allow investors to see a handsome profit while reducing business risks.

Hence, export is a condition and a cornerstone for the success of the model.

THE CORNERSTONES TO THE ADI MODEL

Agro-Development Investment (ADI) model results from understanding the involved parties, what each can give versus wishes to gain.

We concluded that everybody could benefit more through cooperation than the current state of no or little collaboration.

We also understood that we need to strengthen or add some critical features, which the ADI model couldn’t do without, including:

1. TRUST – Increase the level of trust between parties, which will enable transactions of money, goods, services, and produce between the parties.

2. QUALITY – Increased quality through professionalism to deliver the promised and expected improved results, aligned with desired financial results.

3. CONFIDENCE – Limitation of ‘surprises’ (risks) through close monitoring of the farmers’ actions throughout the year and all stages along the value chain.

HOW DOES THE MODEL WORK?

The ADI model is based on the assumption that each of the parties will benefit from increased Trust, Quality of produce, and Confidence in the results.

Hence, these are the cornerstones of the model.

Each of the involved parties needs to get something from one or more of the other parties to perform their duty on the best side.

Here is where the Trusted Partner, an arm of the Green Valley operation, comes in handy in overlooking, watching the alignment of interests, and coordinating exchanges between parties.

Alignment of interests – from experience, we know that when parties are not aligned in their interests, the results will be sub-optimal. For example, a provider of a spray or trap for fruit fly control is unaffected by the farmer’s income once he sold the products and received his money for it.

To overcome the problem of misalignment, we have designed the ADI model to increase parties’ income and ROI whenever the received payment for the produce is increased.

It means that by selling more produce, at higher quality, for a higher price per kg., all parties will benefit more.

Now we can be confident and assured that all parties have a common goal; act to increase revenue from the sale of produce.

PUTTING THE MODEL TO WORK

We developed the ADI model to support farmers, exporters, and providers (of goods, services, etc.) to enhance their business activities based on the Green Valley business and value foundations.

In the coming mango season, for the first time, Green Valley will implement the above business model with selected farmers and business partners.

Accordingly, in the 2021 season, Green Valley will offer its farmers a financial investment that can reach 50% to 70% of Phase 1, basic-package expenses, as detailed below.

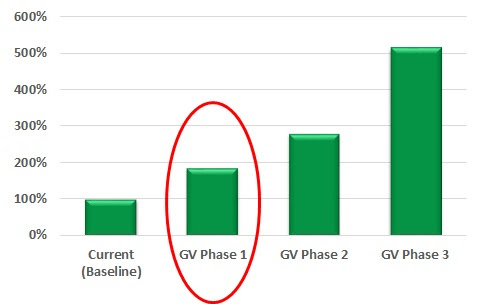

Phase 1: Green Valley basic package, partial content:* Financing – 50% to 70% of approved activities in the frame of the FFCTZ (described below). * Peace of mind – ADI model is bringing-connecting-linking together the different parties combining the supply chain. Hence, providing confidence, saving time, effort, and redundant expenses from its partners. * Fruit Fly Certified Trade Zone (FFCTZ) system-approach full package which includes: Project design. Project design. Project approval. Project approval. FreeDome units (panels and dispensers) for the entire project/farm. FreeDome units (panels and dispensers) for the entire project/farm. Monitoring U-traps (special). Monitoring U-traps (special). Applying and service the control and monitoring units. Applying and service the control and monitoring units. Year-round (12 months) project monitoring and management. Year-round (12 months) project monitoring and management. Technical support and on-site learning. Technical support and on-site learning. Professional supervision and personal advice from Dr. Nimrod, Biofeed’s CEO. Professional supervision and personal advice from Dr. Nimrod, Biofeed’s CEO. Professional relations with regulators in the country and export markets. Professional relations with regulators in the country and export markets. Quality assurance year around and during the harvest. Quality assurance year around and during the harvest. A signed certificate of compliance with the required FFCTZ standard. A signed certificate of compliance with the required FFCTZ standard.* Post-harvest support – by professional experts. * Branding (optional) – to increase income. * Export of produce through leading exporters to premium markets. * Collecting payments and dividing the receivables to partners as set by the agreements. The basic package’s target is to establish a long-term relationship between the parties and to see an income increase by a minimum of 25% for the farmer, already within the first year of the Green Valley activity.After Phase 1 is established, Green Valley will act together with the involved parties to conduct the ADI model Phases 2 and 3 (not described herein) for further investments and income increase.The ADI model is a breakthrough for farmers’ benefit in emerging economies, marking a historic turning point by providing a financial model for supporting farmers turn their production to export markets, hence improving their business.Green Valley was made by a farmer for farmers. Green Valley remains committed to farmers’ and value chain partners’ well-being by increasing exports from Africa and emerging markets to premium markets.Starting today, your path to export is made easy for a bright and prosperous future. Contact me if you would like to invest or participate in the mango value chain in Africa’s agro-industry.My way of keep improving is by getting your feedback and advice. Thanks |

| My way of keep improving is by getting your feedback and advice. Thanks. If you find this article interesting, share it with someone who should see it and benefit from it! |